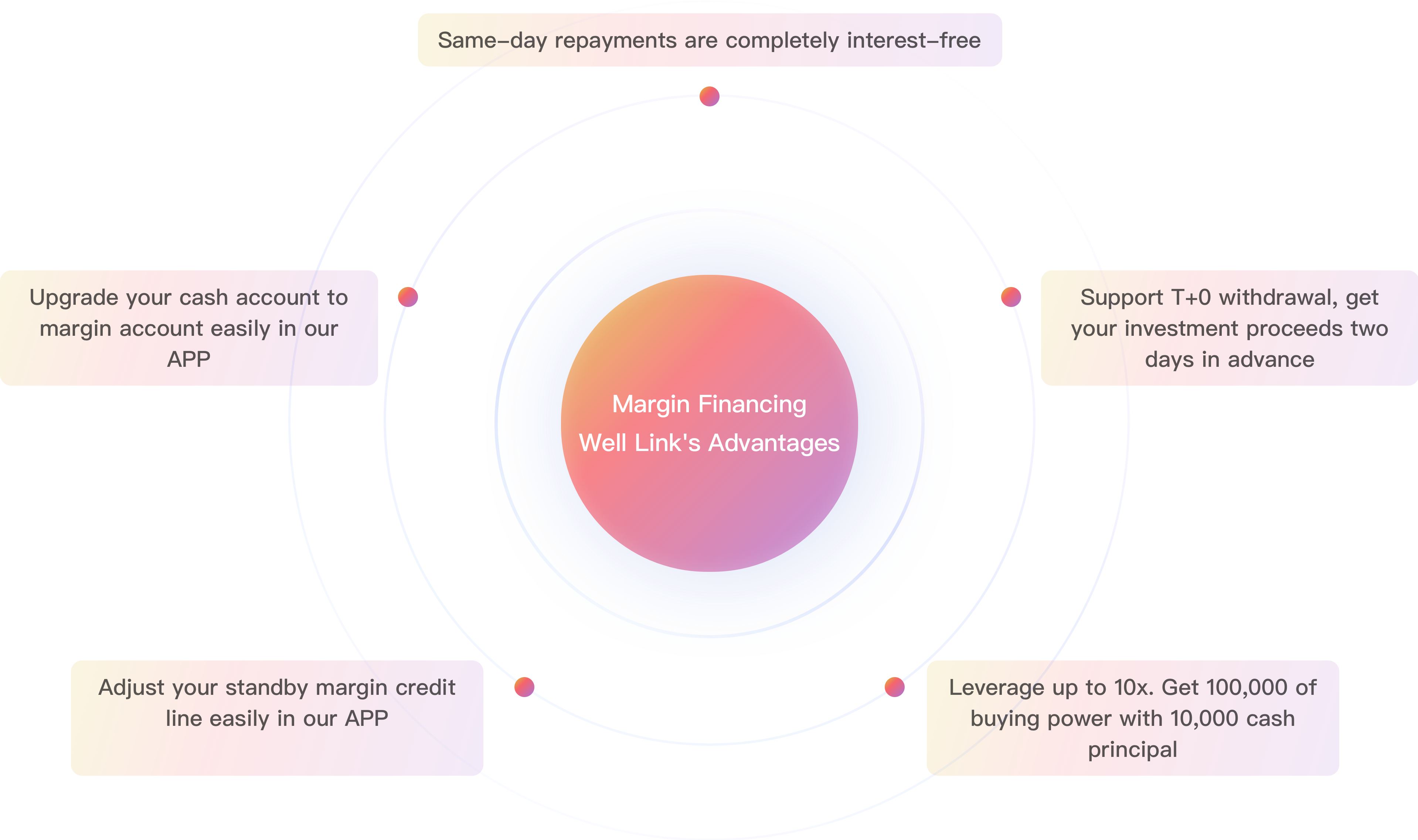

What is a Margin Account

Margin Account: Investors can use stocks as collateral through this account. Based on the value of the stocks collateral and a margin value set by us from time-to-time, you may enhance your buying power with funds provided by us. Leveraged investment will amplify your investment return, but will also increase your investment risks.

How to Upgrade to a Margin Account

Simply access the upgrade process in our APP. You will need to watch a Risk Disclosure video and confirm relevant informations and Risk Disclosure for Margin Accounts to complete the upgrade.

Apply Online

Watch the risk disclosure video to confirm the upgrade.

Upgrade in 5 Minutes

Submit the upgrade application after confirming the risk disclosure.

Same-Day

Approval Upgrade will be successful within one working day.

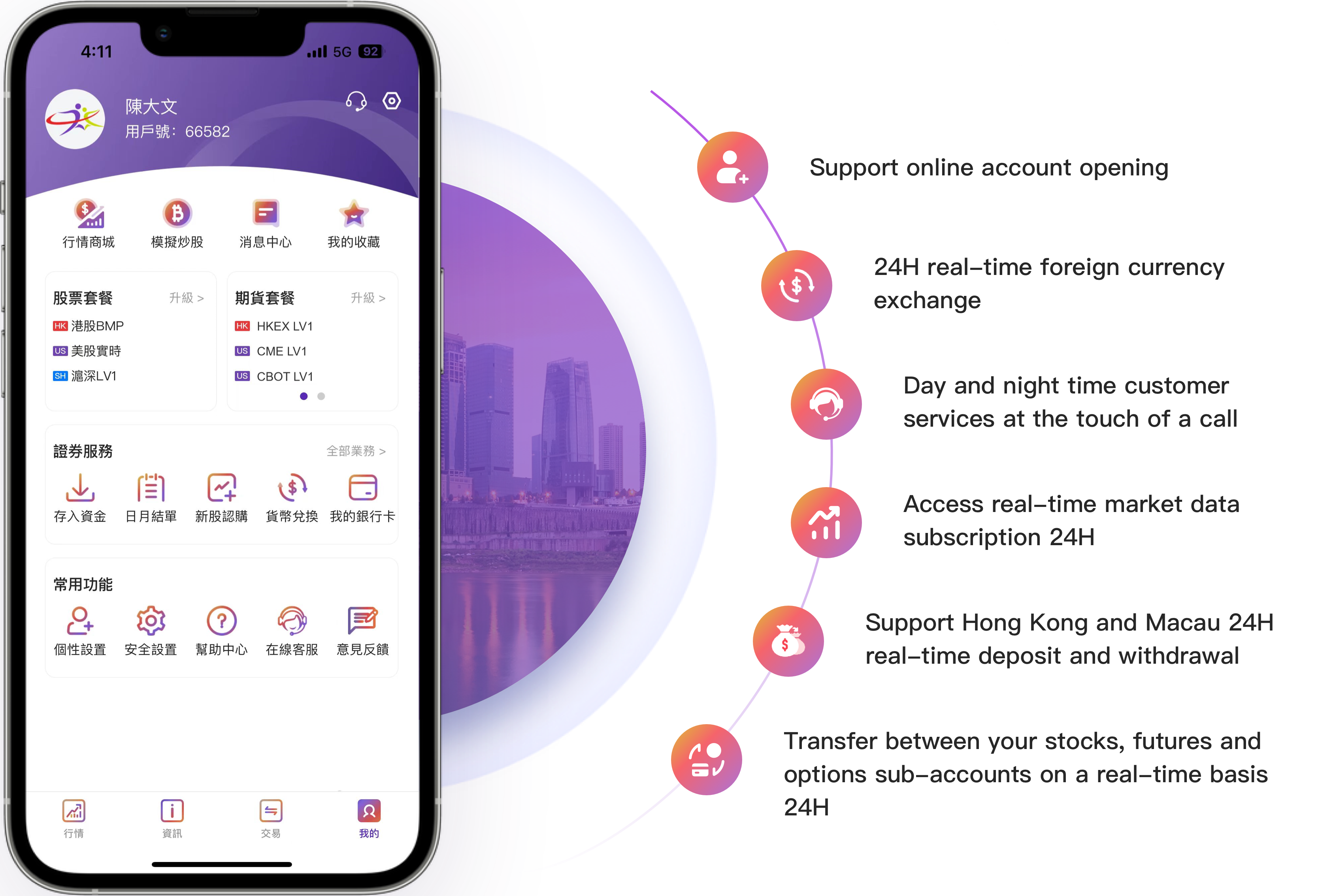

The intelligent service provided by Well Link

Support online account opeing

Support online account opeing 24H real-time foreign curreny exchange

24H real-time foreign curreny exchange Day and night time customer services at the touch of a call

Day and night time customer services at the touch of a call Access real-time market data subscription 24H

Access real-time market data subscription 24H Support Hong Kong and Macau 24H real-time deposit and withdrawal

Support Hong Kong and Macau 24H real-time deposit and withdrawal Transfer between your stocks, futures and options sub-accounts on a real-time basis 24H

Transfer between your stocks, futures and options sub-accounts on a real-time basis 24HClients may open an account with us through the following channels:

1. Online Account Opening via WLISEC website/mobile APP:

Clients may fill in an online application, then:

Arrange for witnessing of signature and certification of documentation OR

- Transfer an initial deposit of not less than HK$10,000 from a bank account in the client's name via a licensed bank in Hong Kong (Designated Bank Account) to Well Link International Securities' designated bank account.

2. In Person

To be served by our Customer Service Manager

Unit 13-15, 11/F., China Merchants Tower, Shun Tak Centre, 168-200 Connaught Road Central, Hong Kong

For further assistance on account opening, please contact +852 2844 9844 (Hong Kong) .

1. For HK ID holders:

Hong Kong Identity Card,

A valid address proof issued not less than three months prior to the account opening date (e.g. Utility bills, Phone bills or bank loan/credit card statements),

Bank account statement

e.g. bank statement, ATM Card with the client’s name and account number

2.For Mainland Clients:

Identity card;

Hong Kong and Macau Entry Permit or PRC Passport,

A stay permit known as “arrival slip” issued by the Hong Kong Immigration Department on entry (not required if not immigrated to Hong Kong),

A valid address proof issued not less than three months prior to the account opening date, including the applicant’s name, address, date and company letterhead (not required if the client’s actual address is the same address shown on ID),

Bank account statement

e.g. bank statements, ATM Card with the client’s name and account number

3.For Other ID Holders:

Identity Card and relevant proof of identity,

A valid address proof issued not less than three months prior to the account opening date (e.g. Utility bills, Phone bills or bank loan/credit card statements),

A stay permit known as “arrival slip” issued by the Hong Kong Immigration Department on entry (not required if not immigrated to Hong Kong),

Bank account statement

e.g. bank statements, ATM Card with the client’s name and account number

When all required documents are received, we can complete the account opening very quickly, approximately three business days. Customers can trade by logging in our mobile application or by contacting our customer services staff(Log in details for mobile trading will be sent to you through email if it opened by offline witness).

1. Deposit from other Banks or Securities Brokers

You may submit the "Stock Transfer Notification" via the Well Link International Securities mobile APP, by clicking on the homepage [My] > [Securities Services] > [Stock Transfer]. For illustration <Click here >

(Note: if the transferee is not identical to the transferor, a duly stamped instrument of transfer with a bought and sold notes must be provided.)

For HK Stock - our Settlement Information:

Well Link International Securities Participant Code:B02139

Contact Person: Settlement Department

Phone Number:+852 2844 9832

For US Stock - our Settlement Information:

Receiving DTC Participant/Clearing Broke:Velox Clearing LLC

DTC No.:3856

Receiver Account Name/Number:Zinvest Global Limited – Other Client / 88ZG0130

Contact Person: Settlement Department

Phone Number:+852 3852 2183

E-mail:settlement@zvsthk.com

(NOTE: Clients who transfer U.S. Stock positions should provide the latest client account statement issued by the counterparty broker for proof of ultimate beneficiary ownership of their shares position.)

For other enquiries, please contact us via telephone at +852 2844 9844 or email at cs@wlis.com.hk

In accordance to the Securities and Futures (Client Money) Rules established under Section 148 and Section 149 of the Securities and Futures Ordinance, Licensed Corporations must place client deposits and securities in a designated trust account. Well Link International Securities strictly oblige to the relevant rules and all client deposits and securities are placed with a trust account in a licensed bank.

Well Link International Securities, as an Exchange Participant of The Stock Exchange of Hong Kong Ltd, has been licensed under the Securities and Futures Commission to carry on Type 1 and 2 (Dealing in Securities and Futures) regulated activities. Under strict regulations from the Hong Kong Securities and Futures Commission, it is an offence for Well Link International Securities to misappropriate client assets under clear authorized is provided by the client.

As an international finance center, the Hong Kong government has always strengthen investor protection measures. Targeting potential losses faced by investors as a result of offenses committed by the financial institutions, the Securities and Futures Ordinance has established an Investor Compensation Fund since 1st April 2003, an independent company responsible for receiving, assessing and determining claims against the Investor Compensation Fund, making payments to claimants and pursuing recoveries against defaulting licensed intermediaries or authorized financial institutions. The compensation limit is $500,000 per investor for trading in securities and futures contracts, respectively. (For more information on the Investor Compensation Fund, you may visit www.hkicc.org.hk)

Deposits

1、Apply via the APP

2、Based on your product account, deposit into Well Link International Securities' bank account::

-

Stock Account:

DBS Bank

Account Number: (016)478-002-004-841

Company Name: Well Link International Securities Limited

Or FPS ID:110144722

-

Futures Account:

DBS Bank

Account Number: (016)478-002-004-841

Company Name: Well Link International Securities Limited

Or FPS ID: 110144722

-

Stock Options Account:

DBS Bank

Account Number: (016)478-002-004-841

Company Name: Well Link International Securities Limited

Or FPS ID: 110144722

3、Upload the deposit screenshot or record to the App or email us at: cs@wlis.com.hk

4、Upon completion of the approval, the cash will be deposited into your account, which should normally take no longer than one business day

*The bank account name will be changed to Well Link International Securities Limited shortly. Further announcements will be made in due course.*

Withdrawal

Apply via the APP to transfer to a same-name bank account, which should normally take no longer than one business day

Securities Trading Service

Our mobile trading platform enables our clients to trade all stocks listed on the Hong Kong Stock Exchange, including Warrants, CBBCs, Exchange Listed Funds (ETF) and inflation-linked retail bond (iBond), as well as China Stock Connect (Shanghai Connect & Shenzhen Connect), along with U.S. securities.

HK Stock Exchange Trading Hours (Monday to Friday, excluding public holidays)

Full Day Trading

Half Day Trading

Pre-opening Session

9:00 a.m. - 9:30 a.m.

9:00 a.m. - 9:30 a.m.

Morning Session

9:30 a.m. - 12:00 noon

9:30 a.m. - 12:00 noon

Extended Morning Session

12:00 noon - 1:00 p.m.

Not applicable

Afternoon Session

1:00 p.m. - 4:00 p.m.

Not applicable

Closing Auction Session

4:00 p.m. to a random

closing between 4:08

p.m. and 4:10 p.m.

12:00 noon to a random

closing between 12:08

p.m. and 12:10 p.m.

| Note: | There is no Extended Morning Session and Afternoon Session on Christmas Eves, New Year and Lunar New Year. There will be no Extended Morning Session if there is no Morning Session. The Hong Kong stock market closes on public holidays. |

US Stock Exchange Trading Hours

Full Day Trading

Half Day Trading

US (EST)

9:30 a.m. - 4:00 p.m.

1:00 p.m. - 5:00 p.m.

HK Time (DST)

9:30 p.m. - 4:00 a.m.

1:00 a.m. – 5:00 a.m.

HK Time (WT)

10:30 p.m. - 5:00 a.m.

2:00 a.m. – 6:00 a.m.

| Note: | Client prior to trading US listed securities, please pay attention to [Notice to Client] About Form W-8 BEN. |

| The denominated currency for the settlement of U.S. stocks is U.S. dollars. | |

| Buy or Sell Trades are to be settled by the second Trade Day (T+1 day). | |

| The minimum trading unit for U.S. stocks is 1 share. | |

| No deposit or withdrawal of U.S. stock in physical form (Physical Script). | |

| We do not accept client instruction on trading and depositing U.S. stocks that are classified as “Publicly Traded Partnerships shares” (“PTP”) , “Over-the-counter” (“OTC”) securities or “Virtual Asset Exchange Traded Funds” (“VA ETFs”). |

CHINA STOCK CONNECT (SSE/SZSE) NORTHBOUND Trading Services

SSE/SZSE Trading Hours

Time for EP to input Northbound orders

Opening Call Auction

9:15 a.m. - 9:25 a.m.

9:10 a.m.-11:30 a.m.

Continuous Auction (Morning)

9:30 a.m. - 11:30 a.m.

9:10 a.m.-11:30 a.m.

Continuous Auction (Afternoon)

1:00 p.m. - 2:57 p.m.

12:55 p.m.-3:00 p.m.

Closing Call Auction

2:57 p.m.-3:00 p.m.

12:55 p.m.-3:00 p.m.

Through a dedicated gateway to the Hong Kong Exchange, our client can access to the Northbound Trading of any eligible A-Shares under the China Stock Connect (Shanghai Connect “SSE” and Shenzhen Connect “SZSE”), including:

The SSE180 Index Constituent Shares

The SSE380 Index Constituent Shares

A+H Shares that are concurrently listed on the HKEX and SSE

The SZSE Component Index Constituent Shares and constituent shares of the SZSE Small/Mid Cap Innovation Index with a market capitalization of not less than RMB 6 billion

A+H Shares that are concurrently listed on the HKEX and SZSE

Note:

Amongst the various stocks listed in the Shanghai Stock Exchange (“SSE”) /Shenzhen Stock Exchange (“SZSE”), only A-Shares are included under the CHINA STOCK CONNECT. Other product categories such as B-Shares, Exchange Traded Funds (“ETF”), Bond and other securities are not included.

The daily limit for transaction turnover of CHINA STOCK CONNECT is restricted by a daily aggregate quota, which is monitored by the Hong Kong Stock Exchange, Shanghai Stock Exchange and Shenzhen Stock Exchange respectively.

Trade order price limit is generally subjected to a ±10% restriction, in reference to the closing price of the previous day, the lower price limit of a buy order must be within 3% of the spot price (5% for ST or *ST shares which are listed on the Risk Alert Board of the SSE).

Transaction funds are settled by T+1 day, while stocks are settled on T day.

No reversal transactions (Day Trading). Shares of a particular stock bought on the day is not allowed to be sold the same day.

Each Lot size is 100 shares.

Only Limit Order is accepted. Trade order amendment is conducted by cancelling the original trade order following the placing of a new trade order.

Trade transactions of China Stock Connect is settled by RMB.

Only Institutional Professional Investors (“ISI”) is eligible for the trading of ChiNext Stock.

Northbound trading will only be open when both the HK and Mainland stock markets are Trade Day and when fund settlement services are available on both market on trade Settlement Day (that is T+1).

IPO Margin Financing

IPO new shares subscription through our nominee is available for our clients to apply via our mobile trading APP or by contacting our Customer Service Team. Allotted shares are deposited into the client's individual securities trading account with us on the allotment day, available for client’s disposal on the new stock’s first trading day. Alternatively, clients can also sell their allotted new shares via the IPO Pre-market (“Grey Market”) by calling our Customer Service Hotline during the IPO Pre-market trading hours.

Further, clients also have the option for Margin IPO Subscription to maximize individual capability which may enhance their chance of allotment.

For announcements of the Hong Kong Futures Exchange, please refer to the website of the exchange:

For Terms of Service on Futures Trading, click here,《Client Securities Account Agreement SCHEDULE VII: Additional Provisions for Futures Contracts and Options Contracts》

Risk Disclosure and Disclaimer

Futures is a financial contract in which buyers and sellers promise to buy or sell a certain related asset, such as stocks, market indices, currencies or commodities, at a predetermined price on a specified date in the future. Investors can buy and sell various futures contracts of relevant assets on the Hong Kong Stock Exchange. They only need to pay a part of the total contract value as a deposit to buy or sell futures contracts. This leverage feature can magnify investors' returns and losses. When the trend of the price of the relevant asset is contrary to the investor's opinion, the risk of being called for margin (“margin call”) may be faced due to a drop in the margin level, and the loss may exceed the margin deposited. Futures contracts are generally settled in cash, and our company does not provide physical delivery of relevant assets.

The risk of loss in trading futures contracts or options can be substantial. In some cases, your losses may exceed the initial margin deposit amount. Even if you may have set contingent instructions, such as "stop loss" or "limit price" instructions, it still may not be able to avoid losses. Market conditions may make it impossible to execute such instructions. You may be required to deposit additional margin at short notice. If the required margin amount is not satisfied within the specified time, your open positions may be liquidated. However, you remain responsible for any resulting shortfall in your account. Therefore, you should research and understand futures contracts and options before trading, and carefully consider whether such trading is suitable for you based on your own financial situation and investment goals. If you trade options, you should familiarize yourself with the rules and procedures, as well as your rights and responsibilities in relation to the exercise and expiration of option contracts.

Therefore, before you trade futures contracts or options, you must have a thorough understanding of the contract terms and trading rules of the relevant products, and you should refer to the relevant information published on the website of the Hong Kong Stock Exchange, and/or consult your professional advisors, as well as carefully consider whether this type of transaction is suitable for you according to your own financial situation and investment objectives.

For the Last trading day/expiration date and Settlement date and holiday schedule of Hong Kong futures, please refer to the website of the Hong Kong Exchange:

Given the spot month Hang Seng Index Futures contracts stop trading at 4:00 p.m. on the settlement day, when would the system's Hang Seng Index Futures "Main Link" be switched to the next contract month?

The contract month for the Hang Seng Index Futures "Main Link" takes into account of the market data received from the Exchange, by evaluating the number of open contracts and the trading volume of the relevant futures market before determining which contract month would be linked for the next trading session. The calculation (Open Interest Quantity x 0.9 + Market Volume x 0.1) takes place after the market closes and customers only need to reconnect to the APP’s market date to reflect the update.

Future Contracts available for trading

At present, the company provides Hang Seng Index Futures, Hang Seng China Enterprises Index Futures, Mini-Hang Seng Index Futures, Mini-Hang Seng China Enterprises Index Futures and Hang Seng Technology Index Futures for clients to trade.

Hang Seng Index (HSI) Futures Contract Specifications

Long-dated Futures::Following five December months

H-Shares Index (HHI) Futures Contract Specifications

Long-dated Futures:Following five December months

Mini Hang Seng Index (MHI) Futures Contract Specifications

Mini H-Shares Index (MHI) Futures Contract Specifications

Hang Seng Tech Index (HTI) Futures Contract Specifications

Other Information:

| Futures Product | Product Symbol | Exchange | Exchange Min. Price Fluctuation | Contract Size |

|---|---|---|---|---|

| Hang Seng Index Futures | HSI | HKEX | 1 tick = HKD50 | HKD 50 x Index |

| H-Shares Index Futures | HHI | HKEX | 1 tick = HKD50 | HKD 50 x Index |

| Mini Hang Seng Index Futures | MHI | HKEX | 1 tick = HKD10 | HKD 10 x Index |

| Mini H-Shares Index Futures | MCH | HKEX | 1 tick = HKD10 | HKD 10 x Index |

| Hang Seng Tech Index Futures | HTI | HKEX | 1 tick = HKD50 | HKD 50 x Index |

| Contract Month | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| Symbol | F | G | H | J | K | M | N | Q | U | V | X | Z |

Examples:

I.The contract symbol of the November 2022 Mini-Hang Seng Index futures contract is MHIX2.

II.The contract symbol of the December 2022 Mini H-Shares Index futures contract is MCHZ2.

III.The contract symbol of the January 2023 the Hang Seng Tech Index Futures contract is HTIF3.

Opening a Futures Trading Account

This can be done via the trading APP by clicking the upper sub menu【Futures】under the main bottom menu【Trade】.

The time it takes to open a Futures Trading Account

In general, 2-3 working days upon application received.

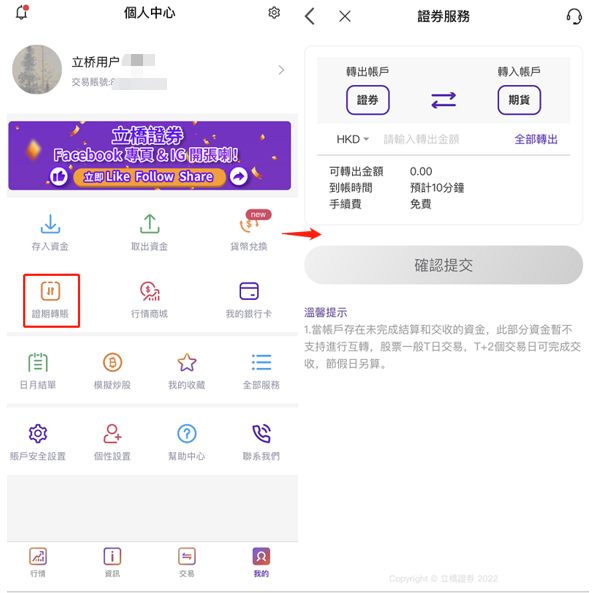

Fund Deposit into Futures Trading Account

This can be done via the Trading APP by clicking 【My】>【SEC-FUT TFR】, for fund transfer between Securities Trading Account and Futures Trading Account. There is no limit on the transferal amount and it general takes 30 minutes to complete.

【NOTICE】

If there is any outstanding balance in the receiving account, the system will automatically offset any outstanding amount with any funds transferred into the receiving account first, meaning any fund deposited will go towards the settlement of any existing debt accumulated in the receiving account with upmost priority. Clients should pay attention to this account offset arrangement before transferring funds between their securities and futures trading accounts so as not to affect their funding and trading management.

Fund Withdrawal Out of Futures Trading Account

This can be done via the Trading APP by clicking 【My】>【SEC-FUT TFR】, for fund transfer between Securities Trading Account and Futures Trading Account. There is no limit on the transferal amount and it general takes 30 minutes to complete.

【NOTICE】

If there is any outstanding balance in the receiving account, the system will automatically offset any outstanding amount with any funds transferred into the receiving account first, meaning any fund deposited will go towards the settlement of any existing debt accumulated in the receiving account with upmost priority. Clients should pay attention to this account offset arrangement before transferring funds between their securities and futures trading accounts so as not to affect their funding and trading management.

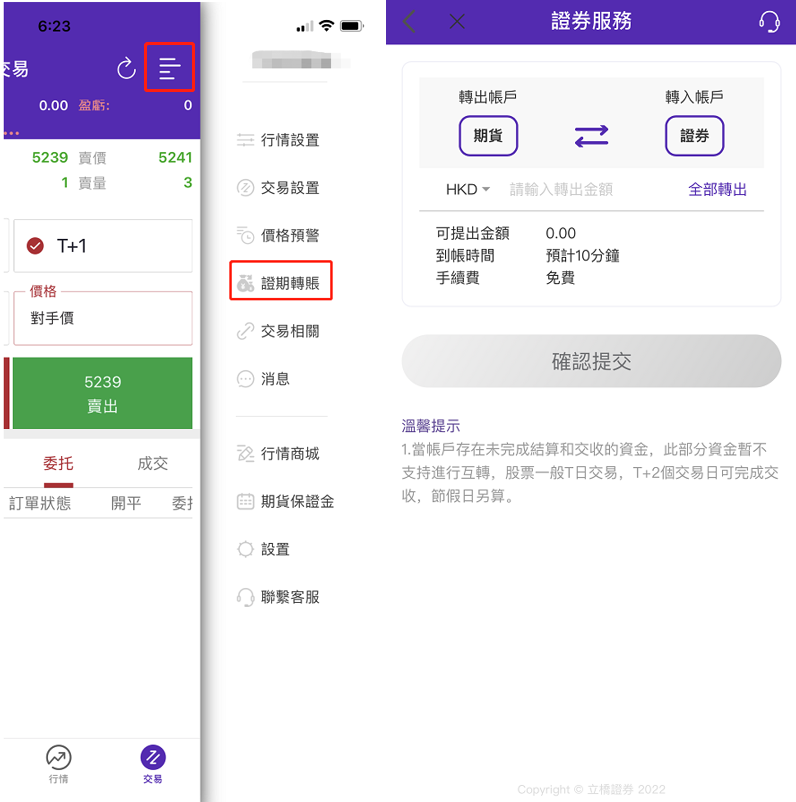

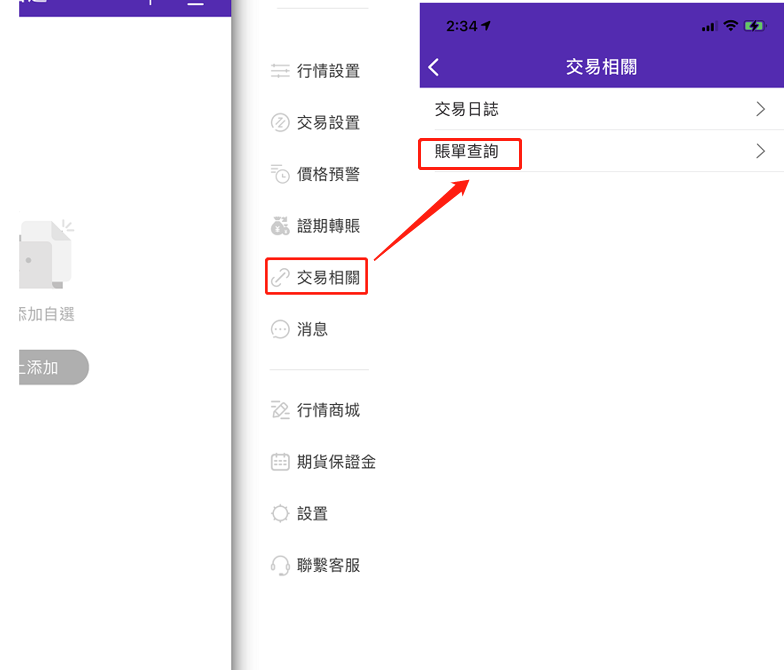

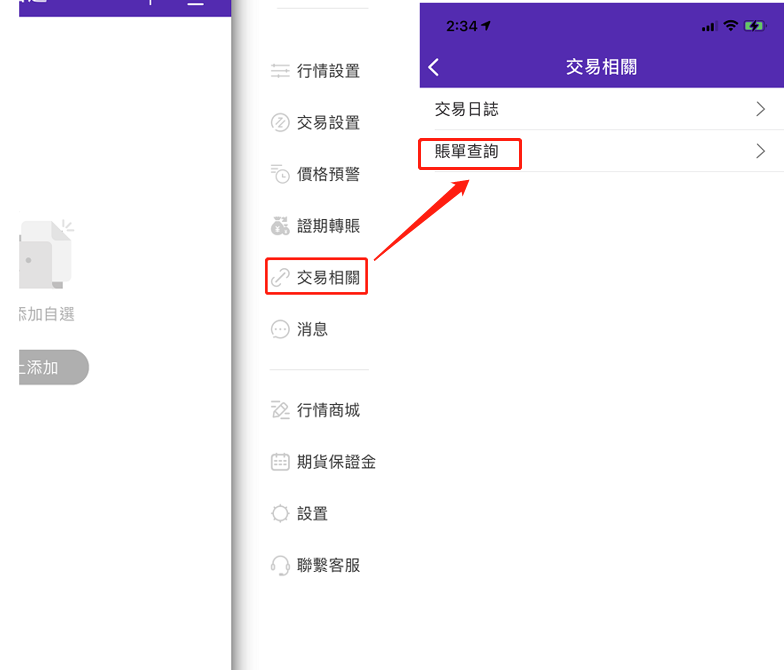

Reviewing Futures Trading Account Statement Online

Client can use the【Trade Related】function under the【Main Menu】to review their Futures Trading Account Statement online.

Futures Trading Account Statement can be viewed online and sent via email. Accounts Statements are encrypted and protected by a password. Client will need to enter the last 6 digits of their Identification document registered during their account opening (ID card/passport for individual clients, business registration/company registration certificate for corporate clients). Enter directly if less than 6 digits, parentheses should be left out. As follow:

Enter:234567

Example 2 : For Macau ID: 1234567(8)

Enter:345678

Example 3 : For PRC ID: 123456194901017890

Enter:017890

Example 4: For Company Business Registration / Certificate of Incorporation :12345

Enter:12345

【NOTICE】

Trade transactions executed during the Day Session (T) will be reflected on the daily account statement for that trade day, whereas trade executed during the After-Hours Trading (AHT) Session (T+1) will reflect on the daily account statement for the next trade day.

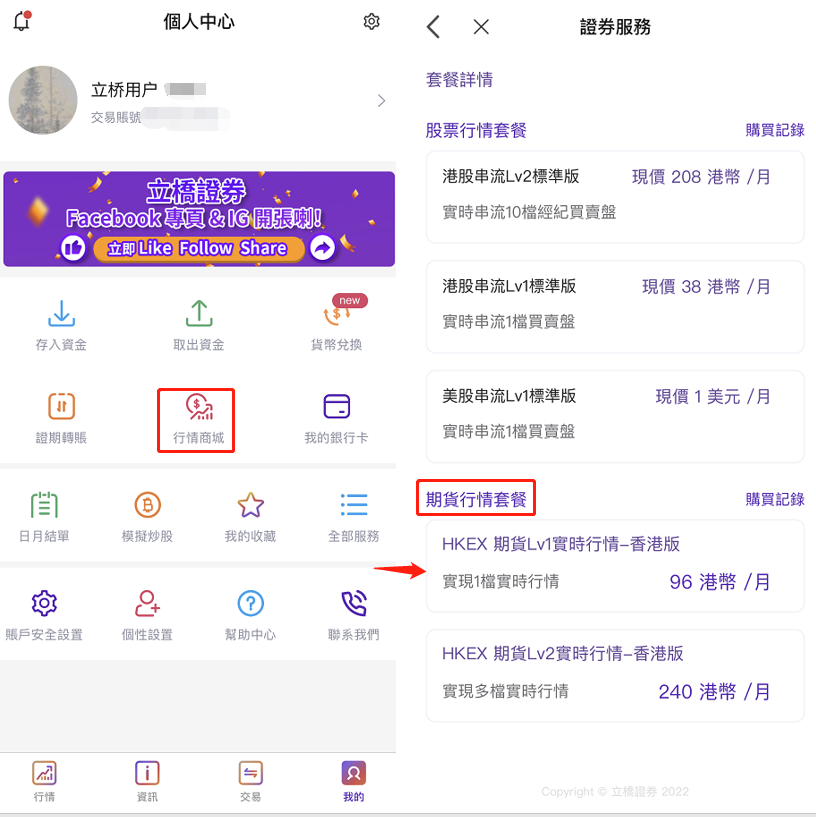

Market Data Subscription for Futures Trading and application time

Before subscribing Market Data for Futures Trading, client shall be aware their subscribed market data will become effective on the next business day. Please “Logout” of the APP and re-login to effect the subscribed market data. Once the subscription order had been accepted with subscription fee deducted from the account, no refund, change or cancelling. Please operate with caution.

【NOTICE】

The trading APP or trading system does not provide any market data for futures trading if clients do not subscribe for futures market data, as such any futures account information that may rely on futures market data to display correctly will not be accurately reflected, which may even effect the normal course of futures trading. Client must acknowledge the relevant risks and take full responsibility for any losses that may be caused by the lack of futures market data before engaging in any futures dealing. If clients decide to conduct futures trading before having successfully subscribed to futures market data, please be fully aware of the associated risks.

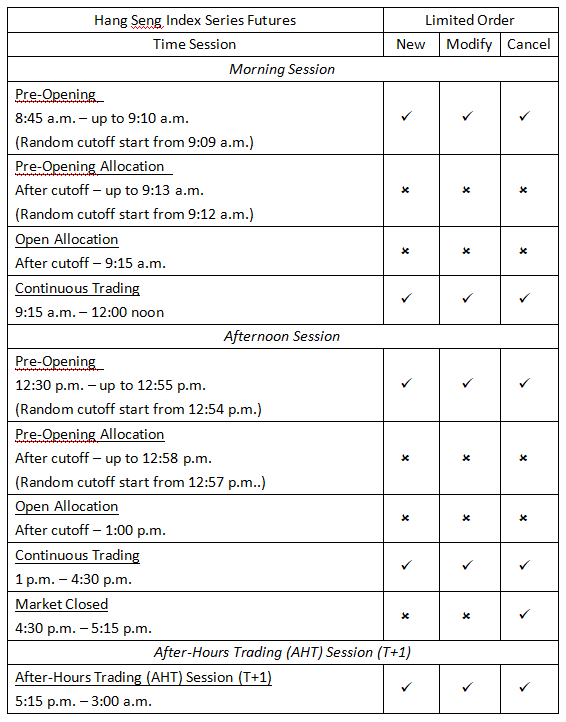

Hang Seng Index Series Futures Trading Time Schedule

【NOTICE】

The market closing time for trading expiring contract month futures on the last trade day is 4:00 p.m.

Device Information Collection

When clients first login the Futures trading function of the APP, they need to agree to the APP collecting their device information so as to meet regulatory requirements.【NOTICE】

Client will not be able to login their Futures trading account if they do not authorize the APP to collect their device information by selecting【Cancel】and re-selecting manually is mandatory if they wish to re-login their Futures trading account.

Authorization on Push Notification via APP

Upon logging in the first time, the client is required to configure the authorization settings for Push Notification in order to receive system messages, including but not limited to trade order status notifications, such as the success or fail of order placement and order cancellation.

【NOTICE】

Client not receiving system messages in time due to them not authorizing the APP for collecting information from their device by selecting 【Cancel】shall be fully responsible for any loss that may cause as a result. After selecting 【Cancel】, client may still be able to configure the permission settings for APP push notifications via the setting menu on their mobile device.

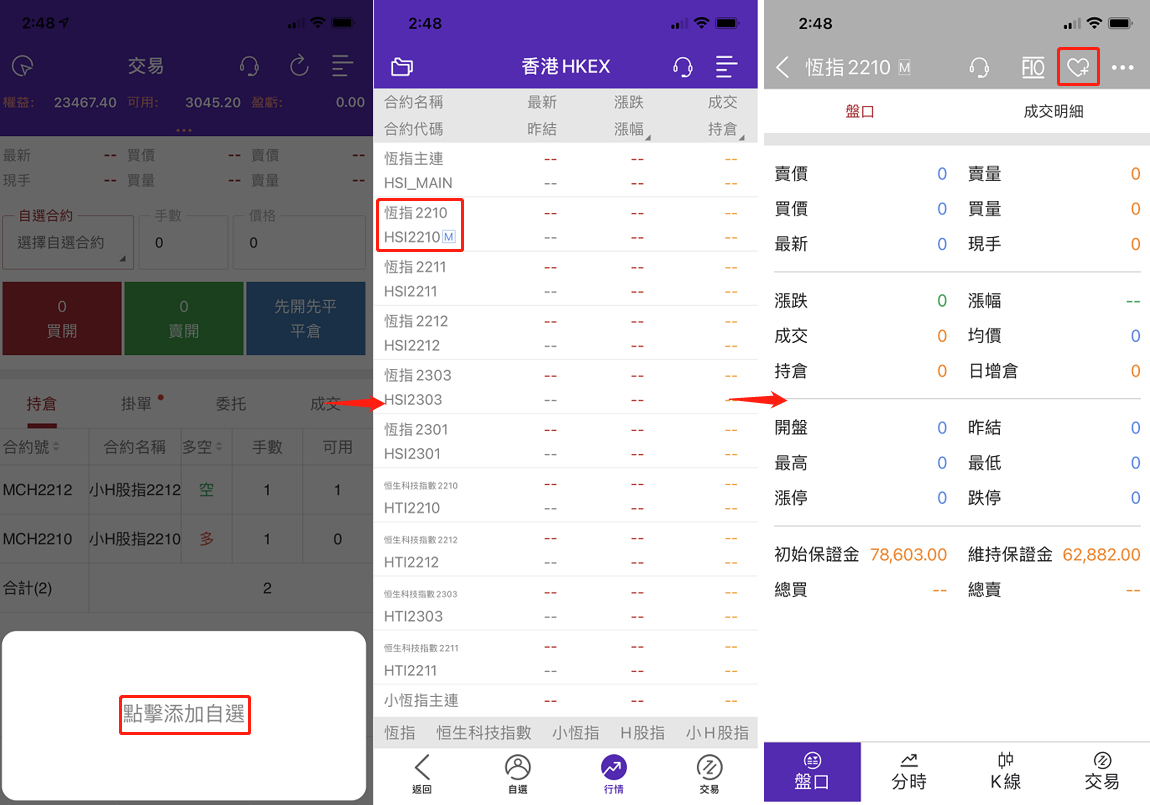

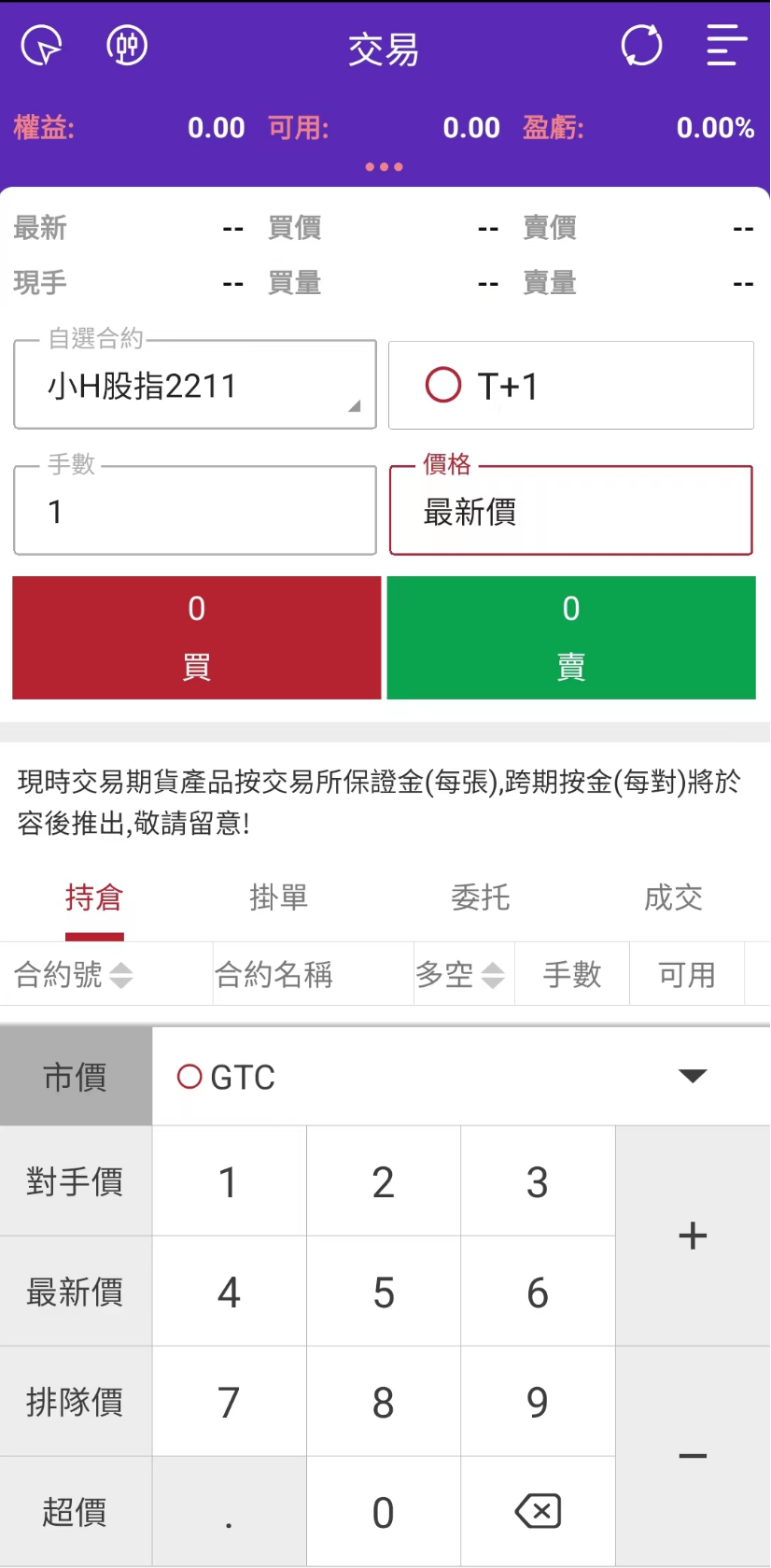

Futures Trading Interface

II. Queue:Display Futures trade order(s) on queue

III. Order:Display Futures trade order status, including the contract name, order price, number of contract(s), time record, valid order type and order feedback.

IV. Executed:Display executed trade order(s).

Order Placement

【NOTICE】

Click the “T+1” tick box when placing order will extend the validity of the trade order onto the After-Hour Trading (AHT) Session.

Modifying or Cancelling Trade Orders

Limit Order and Order Price Type

I. Limit Order

>> Limit Order is a trade order with a price limit. Clients can enter a BUY order or a SELL order with a

price according to the specifications and rules of trading that particular futures contract.

>> If a client places a Limit Order in the Pre-Opening Allocation Period during the Morning Session or the

Afternoon Session, the system will default the order as an Auction Limit Order and engage in Order Matching

during the Open Allocation Session, any unmatched Auction Limit Order(s) will be automatically converted back to

a Limit Order when the Continuous Trading Session begins.

>> Futures Products available for trading: Hang Seng Index Futures (HSI), Hang Seng China Enterprises

Index Futures (HHI), Mini-Hang Seng Index Futures (MHI), Mini-Hang Seng China Enterprises Index Futures (MCH)

and Hang Seng Technology Index Futures (HTI)

II Bid/Ask Price

Set the order price at the level one Bid/Ask price for matching, if the order is partially filled, the remaining

unfilled order quantity will remain in queue as Limit Order.

III. Nominal Price

Set the order price at the nominal price, if the order is partially filled, the remaining unfilled order

quantity will remain in queue as Limit Order.

IV. Queue Price

Set the order price at the best price queue, if the order is partially filled, the remaining unfilled order

quantity will remain in queue as Limit Order.

V. Transcend Price

After the trade order price is entered (regardless of which of the above price type have been selected), the

Transcend Price feature may be used to add extra tick(s) onto the trade order price to increase the likelihood

of order matching especially given volatile market situations. Clients may pre-set the number of tick(s)

under【Main Menu】> 【Trade Settings】> 【Transend Ticks】and the default number of tick is 1.

Nov HSI Futures Contract(+ 【Transcend Price】10 ticks)

Nominal Price: 16,791

Bid Price: 16,786

Ask Price: 16,791

Bid/Ask Offering Price + Transcend Price 10 ticks: Bid 16,801 / Ask 16,776

Nominal Price + Transcend Price 10 ticks: Bid 16,801 / Ask 16,781

Queue Price + Transcend Price 10 ticks: Bid 16,796 / Ask 16,781

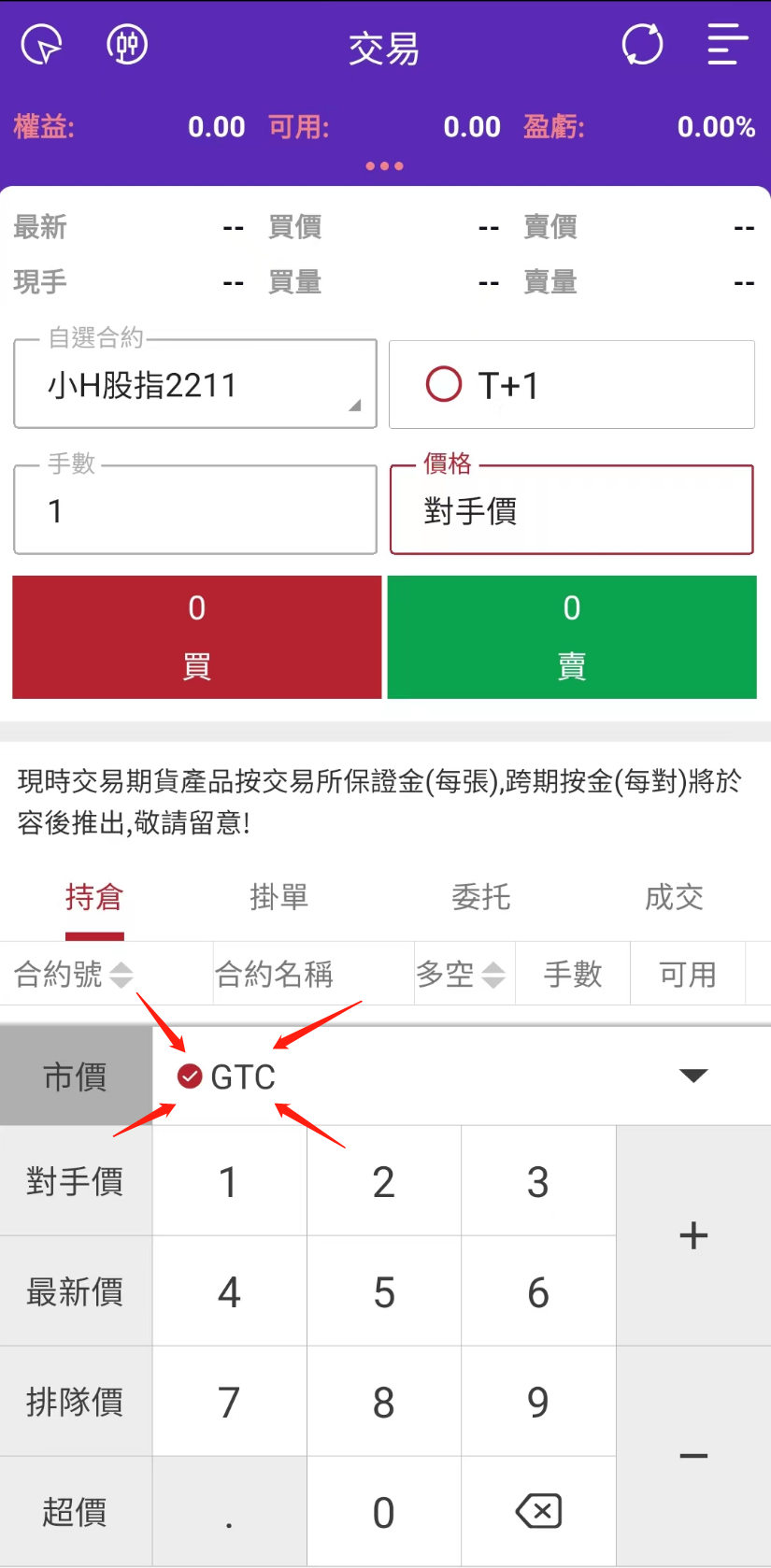

Order Validity

By default, pending orders are valid until market close of the current trading session, and all unfilled orders are automatically voided after the market closes.

【NOTICE】

Unless ”GTC” or “T+1” are selected (Refer to screenshot below)。

Unfilled orders with GTC selected are valid until such time when order is filled or manually canceled, otherwise the validity period of the GTC order will remain until the Futures contract of that trade order expires.

After the market closes on the last trading day, Well Link Securities Limited has the right to cancel clients’ GTC orders of the current (spot) month contract that have not been executed or have not been voluntarily canceled.

【NOTICE】

Clients who choose to place GTC orders must pay attention to the latest order status of their trade orders from time to time. Well Link Securities Limited will not guarantee the validity period of GTC orders.

Futures Products available for trading during After-Hours Trading (AHT) session

(Reference Materials)

Orders placed during Day Trading session (also known as "T session") versus After-Hours Trading session (also known as "Night session" or "T+1 session")

I. Unfilled orders placed during the Day Trading session are valid until the current trading session closes by

default, and all unfilled orders automatically become invalid after the market closes (16:30).

II. Unfilled order placed during the Day Trading session with [T+1] selected, and the validity period of the

order will be extended to the After-Hours Trading session ([T+1]).

III. Orders placed during the After-Hours Trading session【T+1】are defaulted to the current session, and there is

no need to select [T+1]. Please be aware.

IV. Regardless of whether [T+1] is selected or not, unfilled orders placed during the After-Hours Trading

session will be stay valid until the current trading session closes (03:00 am) by default, and all unfilled

orders will automatically become invalid after the market closes.

【Last Trade Day】Trade Order Rules(Applicable to Hong Kong Hang Seng Futures)

Order Price Limit

For details, please refer to the exchange website:

Order Quantity (Futures Contract) Pre-set Limit

II. The maximum number of order quantities (futures contracts) for a single order is limited to 100.

Trade Notifications

Account Transactions Statement

Volatility Control Mechanism (VCM) (Applicable to the Hang Seng Index Series Futures)

If the price of an Exchange contract within the VCM deviates by more than ±5% from the last traded price 5 minutes ago (VCM reference price), a 5-minute cooling-off period will begin.

During the cooling-off period, buying and selling are allowed within price limits. After the cooling-off period, normal trading will resume.

For details, please refer to the exchange website:

Futures Margin (Open Position) Requirements (also known as “Initial Margin”)

Maintenance Margin Requirements

Futures Margin Requirements is divided into "Initial Margin" and "Maintenance Margin", whereas the Maintenance Margin is 80% of the Initial Margin. The amount required for the Initial Margin will be adjusted from time to time according to the requirements of the Exchange, at least adjusting monthly, and it will also be adjusted upward in response to market fluctuations or prior to local long holidays. Before clients open a new position, their futures trading account must have sufficient Initial Margin deposited, while after opening a new position must have sufficient Maintenance Margin in place. All futures margin security deposits must be in cash.

Margin Requirements for Unilateral and Spread Futures Contracts of the Hang Seng Index Series Futures

For details, please refer to the Exchange website:

II. Margin for Spread Futures Contracts

Spread Futures Contract trading is a single futures contract of the same category or the same trading product in

different contract months, trading in opposite directions simultaneously.

【NOTICE】

At present, Well Link Securities Limited’s margin policy for each pair of the Spread Futures Contracts traded by any client will be treated as two independent (Unilateral) futures contracts in terms of margin security deposits requirements.

【NOTICE】

At time of volatile market conditions, the margin security deposits required from the client may be raised to a level higher than the Exchange's Initial Margin requirement, which in turn triggers a margin call. As such, the client may be called for margin and demanded for additional fund deposits in a short period of time, in order to maintain the Initial Margin level of their positions. If the additional margin requirement is not satisfied within the specified time, the client may be forced to close the position at a loss, and all losses arising therefrom, including any amount owed after closing the position, must be borne by the customer.

Margin Call Notifications【Total Initial Margin/Total Net Asset Value】and Force Liquidation

When the net position value or asset valuey of the client’s futures account falls below the Maintenance Margin level, the client will be called for margin security deposits, and the request for margin will usually be triggered according to the risk ratio of the client’s position. When the client is being called for margin, the client should quickly replenish their margin level to the Initial Margin level, or implement adequate risk management in a timely manner by closing their open position(s). Unless the margin call requirement is satisfied, the client will not be allowed for fund withdrawal from their account or opening new positions.

I. When the【Initial Margin】ratio in the client's futures account falls to 80% or below, a margin call notification will be issued, and the client should make the necessary margin deposit as soon as possible or voluntarily close the position until the net asset value returns to the【Initial Margin】requirement level above.

II. When the【Initial Margin】ratio in the client’s futures account falls to 60% or below, further margin call notification will be issued, and the client should immediately make the necessary margin deposit or voluntarily close the position until the net asset value returns to the【Initial Margin】requirement level above.

III. When the【Initial Margin】ratio in the client's futures account falls to 50% or below, forced liquidation may be executed at any time without prior notice or warning until the net position value or asset value of the client’s futures account returns to the【Initial Margin】requirement level.

If the client fails to make the margin call amount within the specified time limit, Well Link Securities Limited has the right to exercise risk management protocol by forcefully closing the position for the client (“force liquidation”) after the specified time limit, without further notice.

I. If the client’s futures trading account is called for margin securities deposits during the Day Trading

session (T), the client must ensure the latest margin call amount in full is available within their futures

trading account by 04:00 p.m. on that day.

II. If the client’s futures trading account is called for margin securities deposits during the After-Hour

Trading session (T+1), the client must ensure the latest margin call amount in full is available within their

futures trading account by 09:00 a.m. in the morning of the next trading day.。

By default, futures contract positions will be closed according to the principle of【First Open, First Close】, where the earliest opened futures contract position is closed first, in that order of priority.

Close Position Fund Settlement

I. Clients closed their position during Day Trading session (T) may apply for fund withdrawal of their margin deposit on the same day, whereas the remaining surplus funds (if any) available in their futures trading account may be further withdrawn on the next trading day at the earliest.

II. Clients closed their position during the After-Hour Trading session (T+1) may apply for fund withdrawal on the next trading day at the earliest.

Last Trading Day Settlement

I. If the client holds a cash-settled futures contract and that contract has not been closed at the end of the Last Trading Day, such contract will be settled in cash according to the contract rules of the Exchange.

II. The settlement amount will be deposited into the client's futures trading account before the commencement of the afternoon trading session of the next trading day following the last Settlement day.

For details of the Last Settlement Date, please refer to the Exchange website:

Open Futures Contracts Offset(1 vs 5)

According to the rules of the Clearing House, the long and short positions of the following four types of Exchange futures contracts may be offset. If clients deem necessary to offset such position, client’s request may be made by calling the Customer Service Department of Well Link Securities Limited to place Closeout instruction before 4:15 p.m. during the Day Trading session (T), whereby such instructions will be executed after the After-Hour Trading session (T+1) session.

I. Simultaneously holding 1 long (short) position in Hang Seng Index futures contract and 5 short (long) positions in Mini Hang Seng Index futures contracts;

II. Simultaneously holding 1 long (short) position in H-Shares Index futures contracts and 5 short (long) positions in Mini H-Shares Index futures contracts.

【NOTICE】

Well Link Securities Limited (“WLSL”) does NOT provide any services in relation to the【physical delivery】of futures contracts settlement, clients is required to voluntarily close their positions on or before the Last Trading Day. Otherwise, WLSL has the right to forcibly close such position for the client without prior notice, and any resulting losses, including costs, fees and expenses, et cetera will be borne by the client.

General Terms and Conditions of being Treated as Established Client (“T&C”)

Before being treated as an Established Client by Well Link International Securities (“WLIS”), please read carefully the terms and conditions outlined below.

1. The Established Client shall be an existing client of WLIS with overnight trading experiences and able to demonstrate a record of consistently meeting margin obligations and maintaining a sound financial position as defined under the Rule 617(b) of HKFE Rules.

[Note] Overnight trading experience means that the client has held overnight positions in the futures/options contract at WLIS for at least ten business days (whether consecutive or not), and has met the minimum margin deposit requirement for each futures/option contract required for carrying the futures/options contract overnight.

2. A record of consistently meeting margin obligations: Consistently meeting margin obligations shall mean that the Client should show no record of failure to meet margin obligations within an immediately preceding record period of at least one year (or, if the Client has not been a client of WLIS for at least one year, for a period since account opening, and with a minimum period of 3 months). In particular, the Client must demonstrate that, during the relevant period, he/she has: no unfulfilled margin calls; no forced liquidation records; and no returned cheques. For new clients, letters, trading records and statements or other formal documentation issued by other licensed or regulated entities may also be acceptable forms or record for assessment.

3. Maintaining a sound financial position: Client should demonstrate that he/she has consistently maintained a sound financial position. The assessment should be relative to the size of the Client’s portfolio, trades, outstanding positions, etc. In assessing the soundness of the Client’s financial position, WLIS may make reference to various types of documents in assessing the Client’s financial position, such as: bank statements; securities account statements; audited financial statements; account opening documents; credit rating reports from reputable credit rating agencies; and/or any statements that prove the credit or financing facility available to the Client. WLIS will also set trading limits for Established Client, based on the assessment on the Client’s financial position.

4. Day Trades: If the Established Client has a history of transacting Day Trades exclusively, WLIS shall not transact a Day Trade on behalf of him/her unless and until the WLIS has received from the established Client collateral adequate to cover his/her minimum margin requirements. Please refer to Rule 617(b) of HKFE Rules for details.

5. The Established Client understands that the funds necessary to fully satisfy his/her margin obligations shall be immediately transmitted.

6. The initial and maintenance margin, as determined by WLIS at the sole discretion of WLIS, shall be maintained by the Established Client in any and all accounts the Established Client may at any time maintain with WLIS. If WLIS determines that additional margin is required, the Established Client agrees to deposit with WLIS such additional margin upon demand by WLIS.

7. The Established Client fully understands the risks associated with being treated as an Established Client, including the potential of magnifying his/her profit and/or loss or even the loss of his/her entire principal, that he/she may have to top up additional margin within a short period of time.

8. If a new position is established by the Established Client during any trading period of any business day, a call for the amount of minimum margin shall be issued by the close of that trading period of that business day by WLIS.

9. The Established Client authorizes WLIS, from 30 minutes before the end of the trading session which the position is opened, at its own absolute discretion, to close out part or all of his/her positions to fulfill the minimum requirement of the relevant overnight positions.

10. If the Established Client decides to keep the position, the Established Client shall meet the full minimum margin requirement (i.e. same as the minimum initial margin requirement determined by the relevant exchange or by WLIS, whichever is higher) by funding in at least 30 minutes before the close of the trading period which the position is established, otherwise WLIS shall be entitled to close out some or all of the Established Client’s open positions without prior notice, as well as terminating the qualified status as an Established Client at any time.

11. The Established Client shall not be permitted to establish new position if the Client has calls for minimum margin which are overdue for settlement.

12. The Established Client agrees to trade with or accept service from WLIS in accordance with the terms and conditions as set out in the Client Securities Account Agreement applicable to the type of account(s) that the client agrees to open.

13. WLIS may discontinue treating the Client as an Established Client without giving prior notice or obtaining consent from the Client if the Client breaches or fails to comply with any provision of the above terms and conditions. The assessment of established client will be subject to at least an annual review.

[Note] Clauses 1, 2, and 4 of this T&C are applicable to HK market applications only.